Ex-RBI governor Raghuram Rajan used the analogy of dosa economics to explain how a fall in interest rates actually ends in higher real returns and thereby increases the purchasing power of investors or pensioners who live on deposit income, at a time when inflation is falling.

What is Dosa’s economics? how it’s related to inflation?

Raghuram Rajan(Ex-RBI Governor) explains with the example of dosa purchasing power.

Assuming a person wants to buy a dosa, at the beginning of the period, a dosa would say cost Rs 50. If the person has a savings of Rs 1 lakh, he could buy 2,000 dosas with the money today. He can get more dosas over a period of time by investing that money.

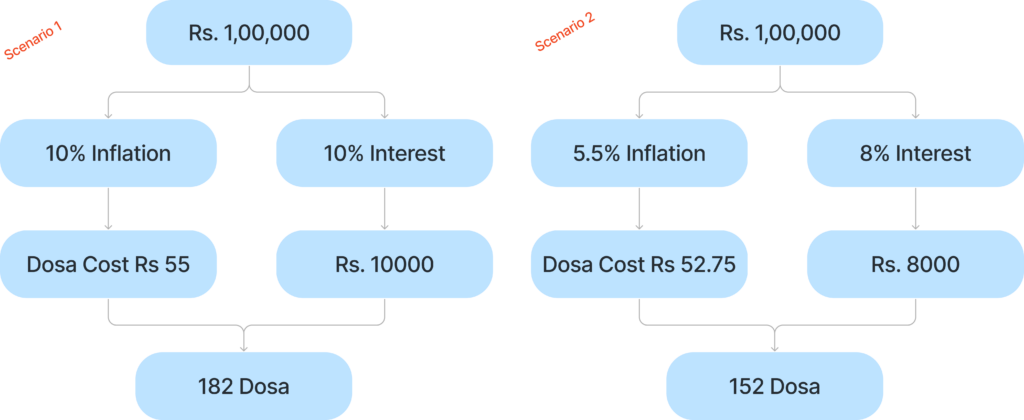

Scenario 1: At 10 percent interest and 10 percent inflation, he gets Rs 10,000 after one year, in addition to the principal. If dosa prices rise 10 percent to Rs 55, he can buy 182 dosas approximately with the Rs 10,000 interest.

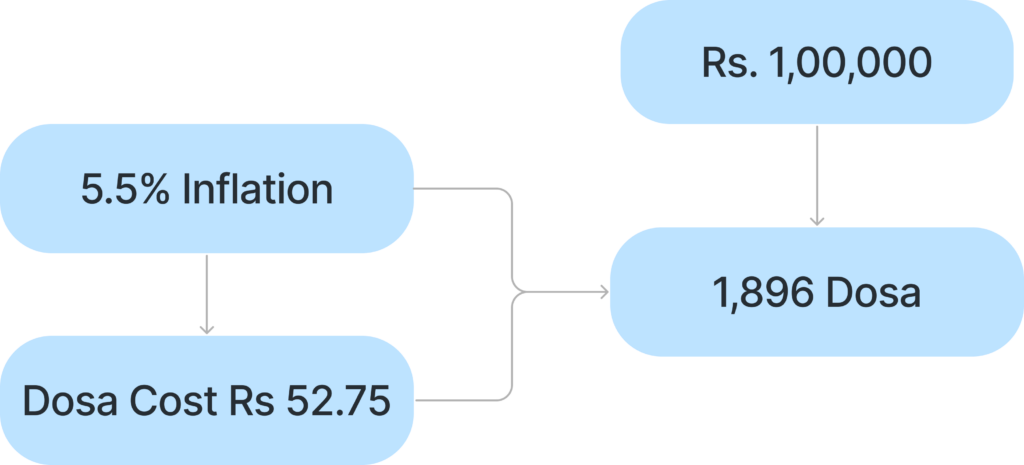

Scenario 2: If the interest rate is 8 percent and assuming lower inflation of 5.5 percent, he gets Rs 8,000. But since dosa prices have gone up by 5.5 percent, each dosa will cost Rs 52.75. This means he can now buy only 152 dosas approximately.

So, the pensioner seems vindicated: with lower interest payments, he can now buy less.

What is the catch here?

10% Inflation/10% Interest scenario 1:

5.5% Inflation/8% Interest scenario 2:

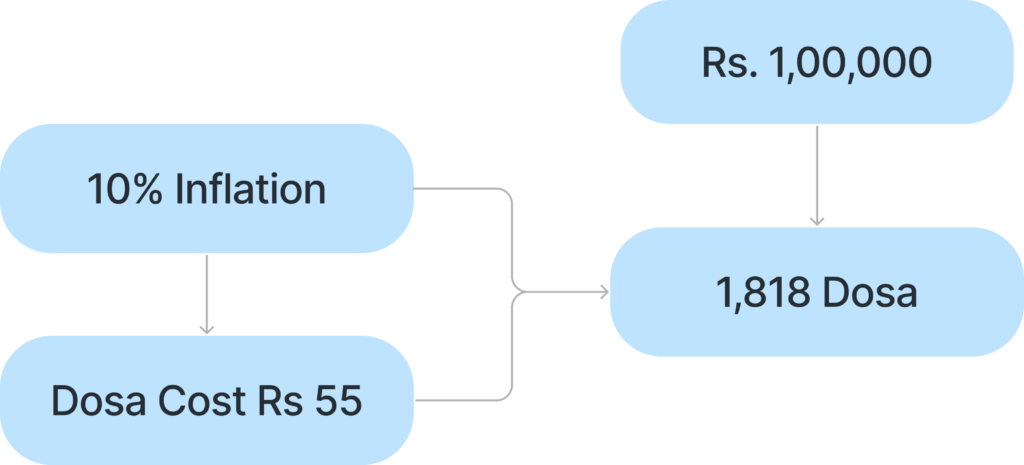

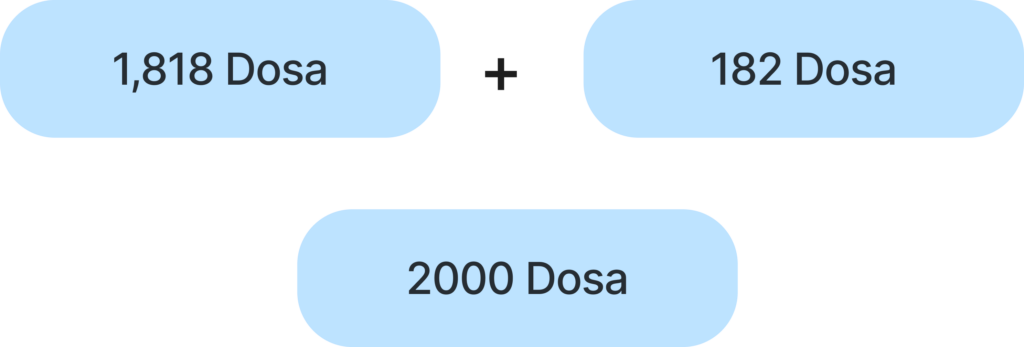

The pensioner gets his principal back also and that too has to be adjusted for inflation. During the high inflation period, his principal of Rs l lakh was worth 1,818 dosas. In the low inflation period, it is worth 1,896 dosas. So in the high inflation period, principal plus interest are worth 2,000 dosas together, while in the low inflation period it is worth 2,048 dosas. He is about 2.5 percent better off in the low inflation period in terms of dosas.

Conclusion

All investors should think about the rate of return but not so much that they neglect the impact of inflation on their principal. Investors should focus more on the Net Returns or the Real Returns that they will be getting on investment as an investment with a high rate of return which would not increase the purchasing power of the investor is not desirable. Only positive Real Returns can increase the purchasing power of an investor. Dosa Economics is a very important theory not only for pensioners investing in an FD but for all investors.